2023 Budget

The Budget was approved by Regional Council on February 2, 2023.

Peel Region maintains infrastructure and provides services such as running water, roads and traffic lights, police departments, waste services, affordable housing, immunization clinics, and more.

The 2023 Budget enables the achievement of Peel's vision of a Community for Life with investments balanced between the needs of residents and businesses and the infrastructure needs of the broader community, advancing Council's priorities and long-term objectives.

Due to the changes to Ontario funding cost-share models and the ongoing COVID-19 pandemic, Peel Region's 2023 Budget has been a challenging budget to develop. Messages from the Region's Chief Administrative Officer Janice Baker, and Chief Financial Officer and Commissioner of Corporate Services Gary Kent, outline the approach to the 2023 Budget and highlight key priority areas for the Region moving forward.

How the Regional Budget Works

Contact us

Questions, comments, or requests for information in an accessible format are welcome and can be emailed to us.

2023 Budget Executive Summary

Service Spotlight

Learn more about some of our services.

Housing Support

Waste Management

Paramedic Services

Seniors Services

Public Health

Early Years and Child Care

Water and Wastewater

Service Business Plans and Presentations

Regionally Controlled Services

Housing Support

Waste Management

Transportation

Paramedic Services

Seniors Services

Public Health

Income Support

Early Years and Child Care

Information and Technology

Community Investment

Business Services

Real Property and Asset Management

Legislative Services

Heritage, Arts and Culture

Land Use Planning

Regional Chair and Council

Water and Wastewater

Regionally Financed External Agencies

Peel Regional Police

Ontario Provincial Police – Town of Caledon

Credit Valley Conservation (CVC)

Toronto and Region Conservation Authority (TRCA)

Conservation Halton (CH)

Assessment Services

Details of the 2023 Budget

The 2023 Budget meets the needs of the community with a net tax levy increase of 6.7 per cent or an overall property tax increase of 2.8 per cent to the taxpayers and a utility rate increase of 7.9 per cent.

Key timelines of the 2023 Budget:

The 2023 Budget consists of:

- Operating expenditures of $3.1 billion

- Capital expenditures of $1.9 billion

2023 total investments: $5.0 Billion

The 2023 Budget includes operating investments of $3.1 billion and capital investments of $1.9 billion to support and advance Council's long term vision for Peel.

People's lives are improved in their time of need.

$1.2 billion (operating)

$0.2 billion (capital)

- Community Investment

- Early Years and Child Care

- Housing Support

- Income Support

- Paramedic Services

- Seniors Services

Communities are integrated, safe, and complete.

$1.7 billion (operating)

$1.7 billion (capital)

- Heritage, Arts and Culture

- Land Use Planning

- Public Health

- Transportation

- Waste Management

- Water and Wastewater

- Assessment Services (MPAC)

- Conservation Authorities

- Police

Government is future-oriented and accountable.

$0.2 million (operating)

$0.03 billion (capital)

- Business Services

- Information and Technology

- Legislative Services

- Real Property and Asset Management

- Regional Chair and Council

2023 Service Enhancements

How we are sustaining current service levels and addressing increased service levels required by a population that's growing and aging by an average of more than 25,000 people a year.

Responding to 11,700 more paramedic response calls

Adding 100 affordable rental units for middle income households

Advancing work to achieve a diverse and inclusive workplace and community

Improving community safety through 70 police officers and 50 civilian positions

Moving towards 4 hours of care for seniors at our long term care homes

Modernizing service delivery by leveraging technology and implementing the digital strategy

Sustaining a safe and healthy community in a post pandemic environment

Maintaining the state of good repair of $36B of infrastructure

Reducing green house gas emissions through strategic capital investments

Zero Emission Waste Collection Vehicle Pilot

Supporting psychological health and wellbeing

Supporting critical infrastructure work for water/wastewater services

How the Budget will affect Property Taxes and Utility Rates

The 2023 Budget includes a property tax increase of 2.8 percent which will contribute an annual increase to the typical residential property and commercial/industrial property tax bills of $144 and $255 respectively.

Additionally, the average home will see an increase to their utility bill of 16¢ per day (or $58 per year), while the average commercial/industrial property will see an increase of 42¢ per day (or $152 per year).

How the Budget increase will affect the average residential and commercial/industrial property

|

Average Residential |

Average Commercial/Industrial |

|---|---|---|

Property Tax Impact of 2.8% 1 |

$144 |

$255 |

Utility Rate Impact of 7.9% 2 |

$58 |

$152 |

Total Impact |

$202 |

$407 |

View previous Regional Budget information.

Other information

Key timelines for the development of the 2023 Budget

| Activity | Council Approved Date |

|---|---|

Approach to the Development of the 2023 Budget – Council Report |

June 23, 2022 |

Peel Regional Police Presentations on Progress Report and Future Outlook |

July 7, 2022 |

January 19, 2023 |

|

| Enterprise Asset Management Program Update 2023 – Council Report | January 19, 2023 |

| 2022 Overview and Update on the Status of Reserves – Council Report | January 19, 2023 |

| 2023 Conversion of External Funded Housing Positions to Permanent Status- Council Report minutes | January 19, 2023 |

| 2023 Fees and Charges – Council Report | February 2, 2023 |

| Fees By-law 5-2023 | February 2, 2023 |

2023 Budget Presentations

| Activity | Date |

|---|---|

| Regional Budget Corporate Overview Presentation | January 19, 2023 |

| Police Services Budget Presentations | January 19, 2023 |

| Regional Services Budget Presentations | January 26, 2023 |

| Conservation Authorities Budget Presentations | February 2, 2023 |

| Additional Budget deliberation | February 9, 2023 |

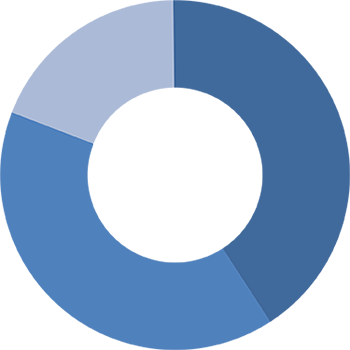

The property tax bill has three components: cost of Regional services, cost of local municipal services, and cost of education. The following chart displays the breakdown of the three components affecting Peel's taxpayer. Of note, the education portion (residential only) of the combined tax bill has not increased for over 20 years.

The proportions vary between the local municipalities, depending on a number of factors including their relative share of total assessed market value by the Municipal Property Assessment Corporation (MPAC).

Where Your Tax Dollar Goes

The Region of Peel provides residents and businesses with essential services such as: running water, roads and traffic lights, police departments, waste services, affordable housing, immunization clinics, and so much more.

- Peel Regional Police: 41¢

- Housing Support: 12¢

- Waste Management: 10¢

- Roads and Transportation: 10¢

- Paramedic Services: 6¢

- Seniors Services: 4¢

- Public Health: 3¢

- Conservation Authorities: 2¢

- Income Support: 2¢

- Capital Allocation: 2¢

- Early Years and Child Care: 2¢

- Information and Technology: 2¢

- Assessment Services: 1¢

- Community Investment: 1¢

- Business Services: 1¢

- Real Property and Asset Management: 1¢

- Legislative Services: < 1¢

- Heritage, Arts and Culture: < 1¢

- Land Use Planning: < 1¢

- Regional Chair and Council: < 1¢

Presentations are prepared for Regional Council as part of the budget decision making process. The presentations include a corporate overview and presentations for both regionally controlled services and regionally financed external organizations. The presentations are available in two formats. They can be viewed as a consolidated package by department, or by each individual service. Our Public notice provides information on written submissions and virtual representations at Regional Council Budget meetings.

Key timelines for the approval of the 2023 Budget:

January 19

- Opening Remarks - CFO

- 2023 Corporate Budget Overview

- Peel Regional Police Presentation

- Ontario Provincial Police (OPP) – Town of Caledon

January 26

- Housing Support

- Waste Management

- Paramedic Services

- Seniors Services

- Public Health

- Early Years and Child Care

- Water and Wastewater

- Transportation

February 2

The following documents contain large-scale map images showing the locations of planned capital projects.

1 Average home assessed at $578,600 and small business valued at $641,900.

2 Average residential consumption at 290m and average small business consumption at 695m.

Questions, comments, or requests for information in an accessible format are welcome and can be emailed to us.