2021 Budget

The Region of Peel's annual budget outlines how tax dollars and utility fees will be invested to help provide the services that you value, such as the operations and maintenance of transportation systems, waste and water services and police services.

The 2021 Budget is one of the most difficult budgets in the past decade. It is a responsible budget that balances the need to maintain core services, protect the community and respect the taxpayer.

In 2016, Regional Council, after extensive consultation with the community, approved the new Strategic Plan for the Region of Peel. The vision for the Strategic Plan is Community for Life and has three areas of focus: Living, Thriving and Leading.

Details of the 2021 Budget

The 2021 Budget meets the needs of the community with a net tax levy increase of 2.5 per cent or an overall property tax increase of 1.02 per cent to the taxpayers and a utility rate increase of 5.5 per cent.

Key timelines of the 2021 Budget:

The 2021 Budget consists of:

- Operating expenditures of $2.7 billion

- Capital expenditures of $1.0 billion

2021 total investment by Council's Areas of Focus: $3.7 Billion

The 2021 Budget includes operating investments of $2.7 billion and capital investments of $1.0 billion to support and advance Council's long term vision for Peel.

Living

People's lives are improved in their time of need.

$970 million (operating)

$176 million (capital)

- Adult Day

- Community Investment

- Early Years and Child Care

- Housing Support

- Income Support

- Long Term Care

- Paramedics

- TransHelp

Thriving

Communities are integrated, safe, and complete.

$1.55 billion (operating)

$779 million (capital)

- Chronic Disease Prevention

- Early Growth and Development

- Heritage, Arts and Culture

- Infectious Disease Prevention

- Land Use Planning

- Roads and Transportation

- Waste Management

- Wastewater

- Water Supply

Leading

Government is future-oriented and accountable.

$164 million (operating)

$44 million (capital)

- Enterprise Programs and Services

- Corporate Services

- Digital and Information Services

- Finance

2021 Service Enhancements

How we are sustaining current service levels and addressing increased service levels required by a population that's growing and aging by an average of more than 20,000 people a year.

Emergency Shelter Operation to Increase up to 60 more beds

Expansion of EarlyON services for 3,000+ children and parents/caregivers

+27 police officers for community safety

Moving towards 75% 3R waste diversion target & 5,000 new households

Water and wastewater service for 4,000 new customers

16 KM more sidewalks and paved shoulders

Implementing Community Safety and Well-being Program

Continuing COVID-19 Response

($1.6M) reduction in tax subsidy of utility operations

Investing in State of Good Repair - $6.8M

60% average increase in social media hits

Enhancing cyber security

How the Budget will affect Property Taxes and Utility Rates

The 2021 Budget includes a property tax increase of 1.02 percent which will contribute an annual increase to the typical residential property and small business property tax bills of $50 and $89 respectively.

Additionally, the average home will see an increase to their utility bill of 12¢ per day (or $43 per year), while the average small business will see an increase of 30¢ per day (or $111 per year).

How the Budget increase will affect the average residential and small business property

|

Average Residential |

Average Small Business |

|---|---|---|

Property Tax Impact of 1.02% 1 |

$50 |

$89 |

Utility Rate Impact of 5.5% 2 |

$43 |

$111 |

Total Impact |

$93 |

$200 |

View previous Regional Budget information.

Other information

Key timelines for the development of the 2021 Budget

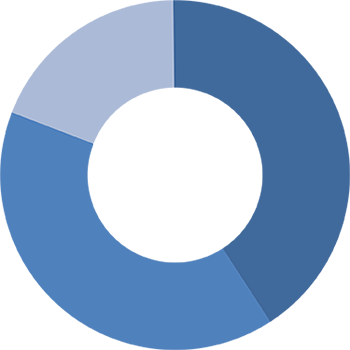

The property tax bill has three components: cost of Regional services, cost of local municipal services, and cost of education. The following chart displays the breakdown of the three components affecting Peel's taxpayer. Of note, the education portion (residential only) of the combined tax bill has not increased for over 20 years.

The proportions vary between the local municipalities, depending on a number of factors including their relative share of total assessed market value by the Municipal Property Assessment Corporation (MPAC).

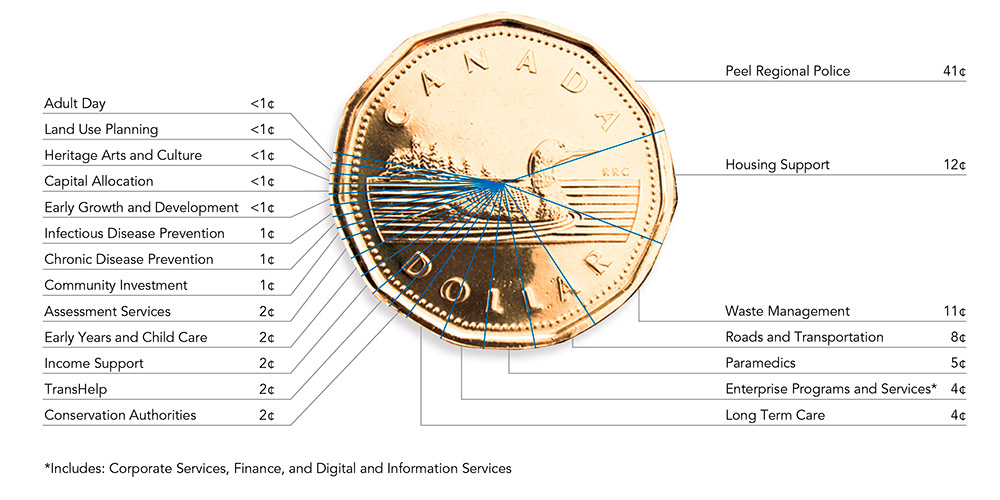

Where Your Tax Dollar Goes

The Region of Peel provides residents and businesses with essential services such as: running water, roads and traffic lights, police departments, waste services, affordable housing, immunization clinics, and so much more.

- Peel Regional Police: 41¢

- Housing Support: 12¢

- Waste Management: 11¢

- Roads and Transportation: 8¢

- Paramedics: 5¢

- Enterprise Programs and Services: 4¢*

- Long Term Care: 4¢

- Conservation Authorities: 2¢

- TransHelp: 2¢

- Income Support: 2¢

- Early Years and Child Care: 2¢

- Assessment Services: 2¢

- Community Investment: 1¢

- Chronic Disease Prevention: 1¢

- Infectious Disease Prevention: 1¢

- Capital Infrastructure: < 1¢

- Early Growth and Development: < 1¢

- Heritage Arts and Culture: < 1¢

- Land Use Planning: < 1¢

- Adult Day: < 1¢

* Includes: Corporate Services, Finance, and Digital and Information Services

Presentations are prepared for Regional Council as part of the budget decision making process. The presentations include a corporate overview and presentations for both regionally controlled services and regionally financed external organizations. The presentations are available in two formats. They can be viewed as a consolidated package by department, or by each individual service. Our Public Notice provides information about attending a Regional Council Budget meeting in person.

Key timelines for the approval of the 2021 Budget:

January 28, 2021

January 28, 2021 – Regionally Controlled Services

Consolidated Presentations by Department

Living

- Adult Day

- Community Investment

- Early Years and Child care

- Housing Support

- Income Support

- Long Term Care

- Paramedic Services

- TransHelp

Thriving

- Chronic Disease Prevention

- Early Growth and Development

- Heritage, Arts and Culture

- Infectious Disease Prevention

- Land Use Planning

- Roads and Transportation

- Waste Management

- Wastewater

- Water Supply

Leading

February 4, 2021

2021 Corporate Budget Overview

Thriving – Regionally Financed External Organizations

- Peel Regional Police

- Ontario Provincial Police (OPP) – Town of Caledon

- Conservation Halton

- Toronto and Region Conservation Authority

- Credit Valley Conservation Authority

February 11, 2021

2021 Corporate Budget Overview

Budget Documents

The 2021 Budget Document includes an Executive Summary and the Full Budget Document.

The following documents contain large-scale map images showing the locations of planned capital projects for the period 2021–2030 and 2021–2041.

1 average home assessed at $578,200 and small business valued at $641,900.

2 average residential consumption at 290m3 and average small business consumption at 695m3.